FP&A Experience

In more than five years as Vice President Business & Control, in my role as Group Controller and in my Performance Improvement consulting, I have focused on transformation almost as much as delivering top quality reports.

Transformation takes two forms “change” and continuous improvement. The goals are similar: increasing Business Insight, to facilitate future management decisions, to evaluate the success of chosen strategies, and for routine, risk and statutory control purposes.

Control and statutory reporting despite being a tool for external communication are costs to a company. As such my task is to minimise these costs. The focus of efforts in Financial Planning & Analysis is to create Corporate Value. This is done through detail analysis of commercial structure, through analysis of trends related to developed Forward Looking Indicators, and Key Performance Indicators. On a larger scale, tools like Dupont Trees and Economic Value-added analysis have been implemented to forecast future stakeholder value.

The Core function was routine delivery of Corporate reports and presentations for both the Executive and Supervisory Boards, support for Investor Relations and External Communications and the support of the Accountants in external statutory reporting.

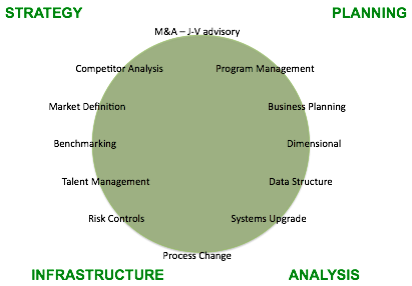

Transformation was achieved related to a number of factors highlighted in the diagram to right. The results unified Corporate, Division and Business Unit management with common data, information and approach.

Process Change

Task, document flow and resource analysis made for the department. Time and motion analysis was prepared.

Handling processes, documentation review, and controls definition

Benchmarking of processes against “best practice” organisations (internal & external, e.g. Philips, Stork)

Task allocation, redundancy requirements (the ability of staff to take over other staff functions due to sickness/absenteeism/vacation) defined. Overall resource requirements defined for short and longer term (with view to long term cost savings)

Documentation prepared

I have been introduced to basic 6 Sigma principles from a management perpective.

Installed a project team to develop globally utilised best practice processes bringing expertise from global operations units together to compare local needs and practices and reduce “not invented here” syndrome.

Introduced systematic teleconferences for remote staff, with strict agendas and requirements in order to improve communication with remote organisation.

Result: significant reduction in turnaround time at Corporate level and at Division and Business Unit level. Shorter turnaround times result in more relevant information for Corporate decision-making

Systems Upgrade

Migration of Financial consolidation package from Hyperion Enterprise to Hyperion Financial Management

Reviewed and upgraded (historical) data to eliminate “discrepancies” between reported figures and those in the database – generated a comparable figure history of 3 plus years

Data made consistent with IFRS introduction

Data made consistent with revision of Corporate structure

Implemented a full record of different scenarios in order to upload quantitative strategic data, budget, forecasts, and reported figures.

Participation in team to define SAP project for Division level (multi country implementation) including Common Chart of Accounts structure, data structure and data dimensional structure to provide an implementation able to support local statutory, Corporate statutory and management business support reporting.

Participation in IT team to define Service Level Agreement for IT support for financial applications (Hyperion Financial Management, SAP).

Data Structure

Part of team that developed the Common Chart of Accounts (together with consultants, Group and Division Controllers and team of business unit experts) for use in all countries, business units, divisions for local statutory, Corporate statutory and management business support reporting.

Wrote/upgraded definitions for the Chart of Accounts and built an Access database for definitions of these - accessible to all financial staff worldwide. Implemented an on-line Corporate Finance Manual for global use.

Participated in Global Corporate Workgroup for Accounting and Reporting

Dimensional

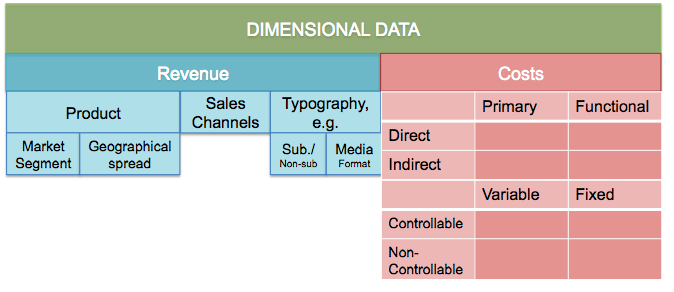

Worked in a group to define the dimensional analysis of financial Corporate data.

Defined dimensions to facilitate statutory requirements and to provide standardised management information for business analysis and management reporting. This included the implementation of full scenario reporting described above.

A top-level example of how it may be structured is illustrated:

Report Structure & Focus

Quantitative inputs were upgraded and standard reports built. A management dashboard was designed and built to monitor key figures. Note: Reort building was generated in a cycle of Routine Reports were built in Hyperion Reports (to enable batch publishing), new reports, requested but not yet proven were built in Excel/Hyperion Retrieve and once accepted, rebuilt in Hyperion Reports, ad hoc and graphical reports were made in Excel/Hyperion Retrieve. In all reports, internal control processes were either built in or built into the work processes.

Qualitative information was added to the reports, and procedures designed and put into place to gather this information. Calendar teleconferences, e-mails, etc were implemented.

Analysis was introduced into business specific aspects, and quarter focus reports introduced with a deep dive into specific indicators.

Timetables for data were built and agreed annually.

Turnaround time was reduced dramatically through quality and process improvement and through report standardisation.

Key Performance Indicators and Forward Looking Indicators were identified at Corporate, Division and Business Unit level. These were implemented validated and reported, and trend lines produced to validate budgeting and forecasts.

Business Planning

15 years of building Business Plans - bottom up and top down, based on building commercial assumptions and sales and marketing channel costs through to cost assumption building. I have built plans for small businesses, such as a boutique advertising agency and a digital TV channel and larger organisations such as a Mobile Telephone Operator and to build airplanes (the latter 2 with 20 year prognoses).

At Wolters Kluwer I brought long term planning to the Business Analysis & Control department (previously in the treasury) and was therefore involved in Balance sheet and debt structures as well as defining valuation and scenario models. This involvement led to involvement in Bank negotiation to decide use of disposal funds and for acquisition funding requirements.

Also ROIC and EVA analysis was introduced. This was primarily for use at Corporate office and at Division level for performance reporting and management bonus evaluation. It was also used as a tool for project analysis at business unit level to evaluate major projects or acquisitions.

I gave training to finance staff (division and business unit level) in the roll out of this technique globally.

Programme Management

Involved in the restructure team for Project Development and Evaluation (also involved in building standard templates for projects for financial and commercial evaluation - go and no-go decision-making, again using EVA and Pay-Back period as tools), as well as a risk assessment as to feasibility of plan and achievability of planned savings.

Built and managed the Programme Management Office for managing about 200 restructure projects:

•built the technical infrastructure and reporting tools

•helped define and validate the financial baseline

•controlled milestone achievement

•financial control of results versus plans, budgets, and forecast.

•analysis of one-off restructure costs and ongoing costs following restructure.

Note: I have been using standard project management techniques for my whole career from Schlumberger to date. Of course the need is different for a project of a few days or weeks and one for a number of months or years. As such the sophistication and detail of the planning tools also changes from project to project. I have had formal training at least 3 times during my career and believe strongly in creating milestones and goals even for routine work.

M&A - joint Venture advisory and evaluation

I have 8-10 years of lead advisory experience at PriceWaterhouseCoopers see tab LA TMT detail for more information

At Wolters Kluwer, my involvement developed from a role as lead advisor to a more Corporate perspective. I monitored performance of acquisitions made by Wolters Kluwer for a period of three years post-acquisition, sufficient to validate the wisdom of the purchase against deal book projections of acquisition and integration costs and planned synergy benefits.

Through my involvement in long term planning, I became involved in decision-making around the use of funds from disposals and the funding of acquisitions to be made.

I was involved in the evaluation of a number of transactions and also in the evaluation of large outsourcing projects related to finance functions.

Competitor Analysis

On my arrival at Wolters Kluwer there was limited resources for Corporate Strategy. This was done largely decentralised at Division and Business Unit level (Portfolio model). I became involved in the strategy determination, working together with newly appointed Strategy Director to build a template for strategic determination. My focus was on the link between a quantitative analysis of the competitors - for example (segment) market share, market growth, financial size and performance versus Wolters Kluwer.

I introduced a link between these figures and the long term planning and reporting.

Market definition

During my period we made significant advances in the definition of customer markets and the size and growth of these markets. These were segmented in a way that facilitates a more global approach to segmentation.

Benchmarking

I introduced internal and external benchmarking of revenue, costs and performance indicators.

External benchmarking was performed against comparable listed companies within our peer group. This tends to be of need lower frequency based on reporting schedules of competitor companies.

Internal benchmarking was prepared for comparison between similar businesses within the organisation.

Talent Management

I participated in a project to design and evaluate target setting for the Long Term Incentive Plan for senior management and staff.

I participated in a team to design a talent management programme for high potential staff, including profile building for the desired “perfect” profile.

I managed my own team setting short and medium term goals, facilitating suited development. Having self work under Management by Objectives for 11 years, I tend towards this style of management. I do realise that feedback loops are essential and that staff need to discuss progress at least monthly, rather than waiting to year end.

Risk Controls

I wrote the risk controls and procedures for the FP&A department. This consisted of the reporting an closing the books cycle and the business planning and budgeting cycle.

This provides the basis for control and feedback loops used to manage department outputs.